MEGA is a global technology company focused on security, privacy and performance for storage and sharing since 2013. User generated end-to-end encryption guaranteeing personal data safety to +250 million users.

MEGA aim to segment it users based on their usage patterns in order to improve its product and better serve its audience.

2 UX Designers

1 Product owner

1 Content / UX writer

1 Business analyst

Write User interview scripts

Facilitate + Conduct User interviews

Analyse Data

Create Personas

Design user plans

Design landing pages

From data analysis, create user personas to represent different segments of the audience and redesign dedicated offers and content in the website.

From data analysis, create user personas to represent different segments of the audience and redesign dedicated offers and content in the website.

In addition to the demographics, we identified the parameters to check and focused our UX research on :

After brainstorming on the questions, we submit a survey produced on Maze to MEGA user database. 23 questions scoping the targeted parameters in a quantitative + qualitative form. 355 participants responded.

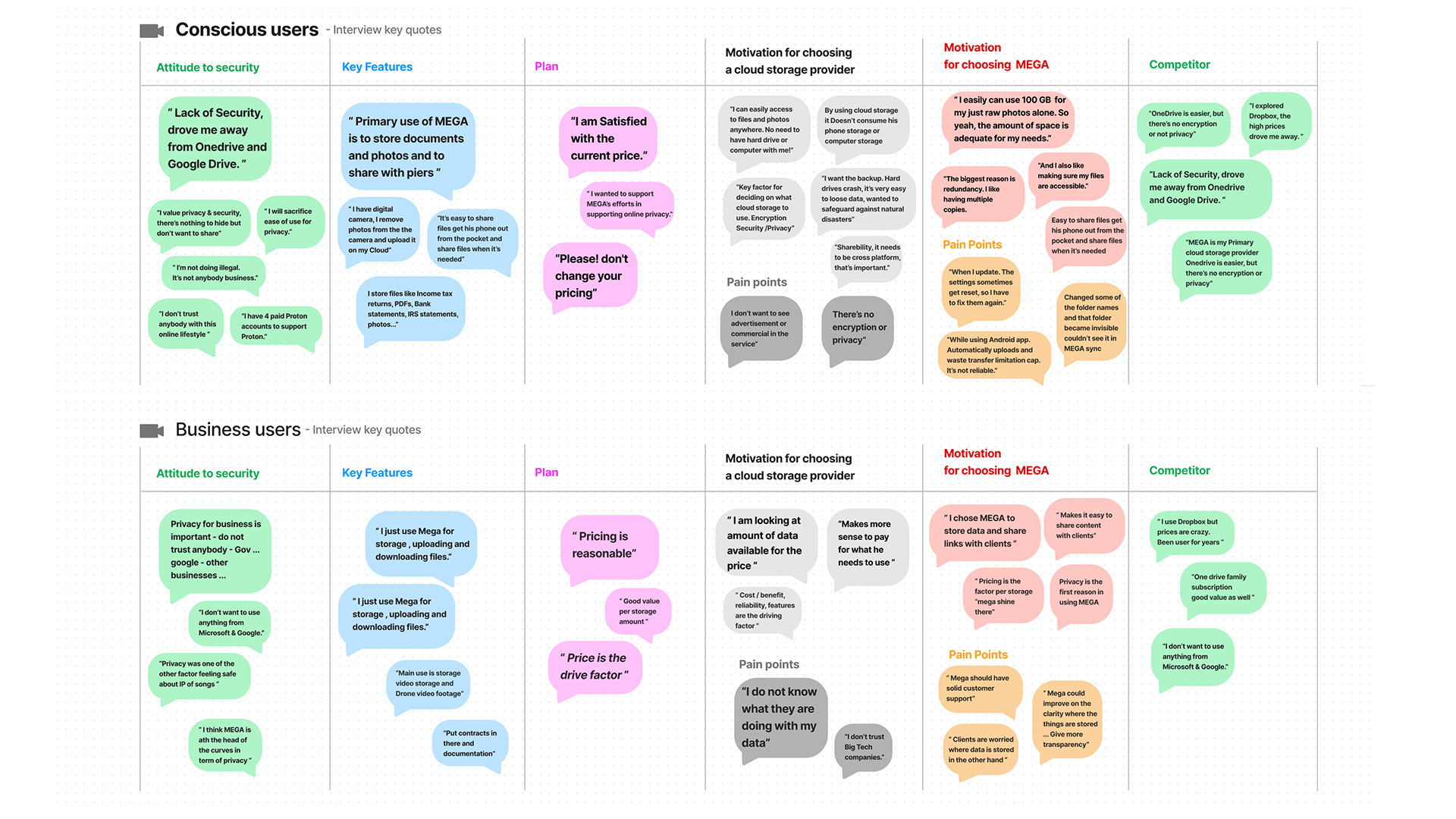

After collaborative brainstorming on the questions, we agreed on a common script structure scoping the themes of interest with divergent parts on business use case, plans or status.

Using the survey database we reached people who volunteered for user interviews. We used Zoom meeting to conduct interviews based on the scripts as users were located all over the globe. (USA, Uk, Canada, Belgium, Sweden, India...)

In addition to the demographics, we identified the parameters to check and focused our UX research on :

After brainstorming on the questions, we submit a survey produced on Maze to MEGA user database. 23 questions scoping the targeted parameters in a quantitative + qualitative form. 355 participants responded.

After collaborative brainstorming on the questions, we agreed on a common script structure scoping the themes of interest with divergent parts on business use case, plans or status.

Using the survey database we reached people who volunteered for user interviews. We used Zoom meeting to conduct interviews based on the scripts as users were located all over the globe. (USA, Uk, Canada, Belgium, Sweden, India...)

Once the survey data exported on an excel sheet and notes/video material from the user interviews, we started our analysis phase.

We created a grid tool on FigJam based on targeted parameters to organise our analysis, then apply use case, plans subscription parameters to deduce observations.

as we found out common patterns behaviours from groups of free plan and paid users.

We extract Students from Entry users, even being as well on free plan, they deserved their own persona as the demographic is high and needs and paint point specific.

Casual users remained a consistent body in the audience with precise motivations and expectations.

As Business users on free plan share similar needs, motivations pain points with Business users on paid plan, we merged then into 1 persona.

Once the survey data exported on an excel sheet and notes/video material from the user interviews, we started our analysis phase.

We created a grid tool on FigJam based on targeted parameters to organise our analysis, then apply use case, plans subscription parameters to deduce observations.

as we found out common patterns behaviours from groups of free plan and paid users.

We extract Students from Entry users, even being as well on free plan, they deserved their own persona as the demographic is high and needs and paint point specific.

Casual users remained a consistent body in the audience with precise motivations and expectations.

As Business users on free plan share similar needs, motivations pain points with Business users on paid plan, we merged then into 1 persona.

Entry Users : represent 50% of Mega users and subscribe to free plans. Primarily motivated by the amount of storage offered. Their pain points are limitation of free storage and desire for more.These users tend to subscribe to a paid plan once their free storage is full or create multiple free accounts.

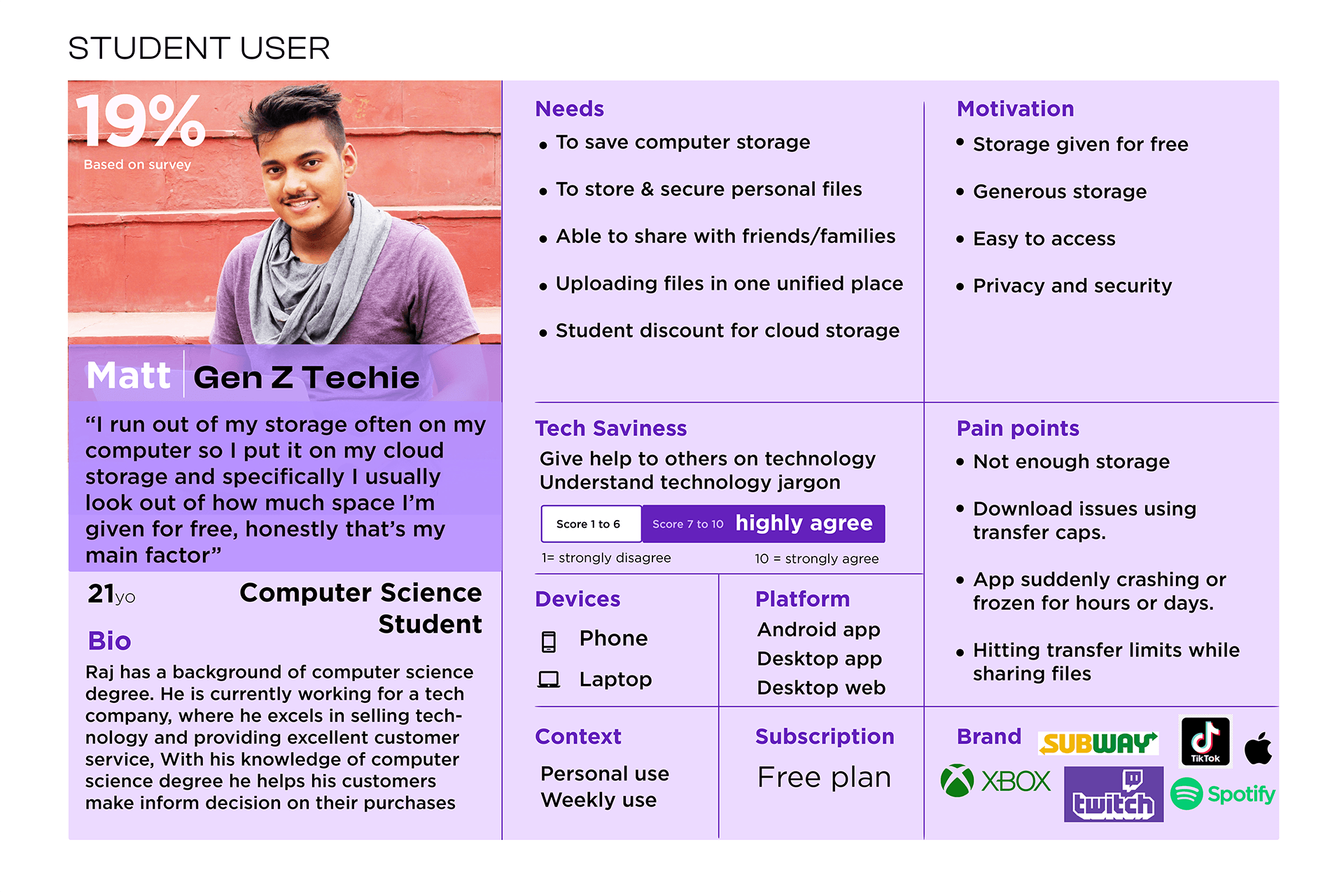

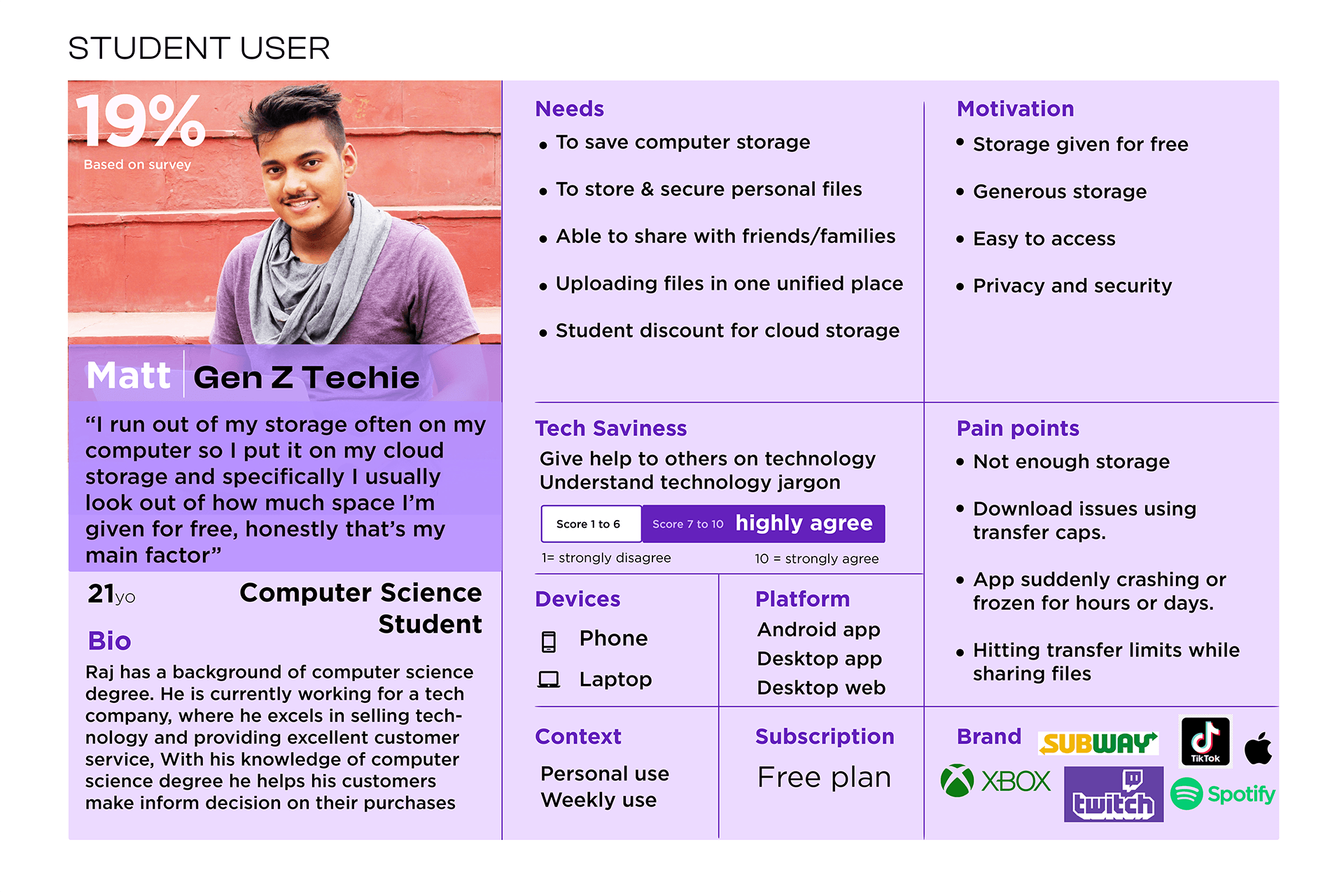

Students : budget sensitive so on free plan, represent 19% of MEGA users. Primarily motivated by MEGA's generous amount of storage, with a free storage capacity of 20GB. Although they have 20GB, their pain point is they would like to have more storage, as they may have financial constraints. Common feedback from this user group is the request for a student plan, as MEGA does not provide this plan

Conscious users : ready to invest on privacy & security represent 16%.These users are the most loyal MEGA users, with 90% of them using MEGA as their primary cloud storage provider.They are very focused on PRIVACY. they are satisfied with the pricing as Mega provides a better offer comparing to other cloud storage providers.They are keen to invest and support MEGA’s efforts to provide online privacy.

Business users : expecting effectiveness and reliability, represent 13% of MEGA users.Business users are driven by their need for security and privacy, and they also require generous storage and their pain point is limitation on bandwidth.Feedback from these users was that they had experienced difficulties when sharing files with clients, as they cannot download the files due to bandwidth limitations.

In the User Research report, we compiled the main findings and observations from the UX research, validating and backing-up the segmentation of each persona.

Entry Users : represent 50% of Mega users and subscribe to free plans. Primarily motivated by the amount of storage offered. Their pain points are limitation of free storage and desire for more.These users tend to subscribe to a paid plan once their free storage is full or create multiple free accounts.

Students : budget sensitive so on free plan, represent 19% of MEGA users. Primarily motivated by MEGA's generous amount of storage, with a free storage capacity of 20GB. Although they have 20GB, their pain point is they would like to have more storage, as they may have financial constraints. Common feedback from this user group is the request for a student plan, as MEGA does not provide this plan

Conscious users : ready to invest on privacy & security represent 16%.These users are the most loyal MEGA users, with 90% of them using MEGA as their primary cloud storage provider.They are very focused on PRIVACY. they are satisfied with the pricing as Mega provides a better offer comparing to other cloud storage providers.They are keen to invest and support MEGA’s efforts to provide online privacy.

Business users : expecting effectiveness and reliability, represent 13% of MEGA users.Business users are driven by their need for security and privacy, and they also require generous storage and their pain point is limitation on bandwidth.Feedback from these users was that they had experienced difficulties when sharing files with clients, as they cannot download the files due to bandwidth limitations.

In the User Research report, we compiled the main findings and observations from the UX research, validating and backing-up the segmentation of each persona.

it helped us to localise the pain points and address solutions inspired from user feedbacks, motivation and needs.

We reshape the offers pricing based on ProLite plan positive feedback from users, so it became our standard.

Top-up solutions for Entry Users that could unlock engagement barriers and solve space storage limits

Special offer dedicated to Students budgets

Fidelity rewards to retain Conscious users (being mostly on ProLite Plan and the most loyal users) as satisfied on the pricing.

Booster solutions for business rush

While keeping in minds motivation needs, we proofed our offers solutions to give more opportunities for Upsell and plan subscriptions.

We also keeps in mind that some users won't subscribe to a paying storage offer.

Thanks to the research insights, we defined specific themes to each persona's to address the right content on social platforms

When not coming from targeted banners or posts from social content,

We tested 2 ways to drive users to their dedicated pages, Quiz and Entry cards, we concluded than the most direct way would be optimal as first time user, so we pick Entry cards.

From that, we prototype the entry card page + landing pages dedicated to each personas needs and motivations.

Open qualitative questions in the survey were not optimal to extract clear and strong results and insights

Scope missing data from survey during user interviews

Profile can be merge as one, as aspiration and motivation tend to be the same even if the engagement is not the same. ( business free > Pro)

Even a demography fits within a larger umbrella, specific needs/motivations can legitimate the creation of a dedicated persona ( students)

Use interviews script as backup and drive casually the interview

Round up numbers results to make User report more digest and legible